Businesses whose annual turnover exceeds a certain limit as prescribed under the GST laws are required to obtain GST registration number.

In order to apply to get the registration, the applicant must have a written authority for it. In case of a company, the certified true copy of board resolution containing the name of the applicant as the authorised signatory for making GST application has to be submitted as a proof.

Here are templates of board resolutions for GST registration. Modify it as necessary.

FORMAT #1

#. To make application for GST registration

“RESOLVED THAT (Name of the Director / Officer), (Designation) be and is hereby authorised to apply to the appropriate authority for GST registration of the company for its .................unit at (address).

FURTHER RESOLVED THAT (Name of the Director/ Officer), (Designation) be and is hereby authorised to sign and execute the application form and any other documents as required for GST registration on behalf of the company and to do all such acts, deeds and things as may be necessary to give effect to the foregoing resolution.”

FORMAT #2

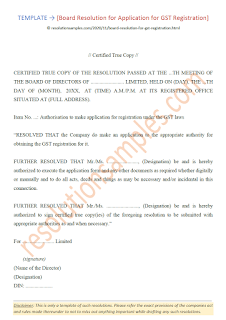

// Certified True Copy //

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED AT THE ...TH MEETING OF THE BOARD OF DIRECTORS OF .......................... LIMITED, HELD ON (DAY), THE ...TH DAY OF (MONTH), 20XX, AT (TIME) A.M./P.M. AT ITS REGISTERED OFFICE SITUATED AT (FULL ADDRESS).

............................................................................................................................................

Item No. ...: Authorisation to make application for registration under the GST laws

“RESOLVED THAT the Company do make an application to the appropriate authority for obtaining the GST registration for it.

FURTHER RESOLVED THAT Mr./Ms. ........................, (Designation) be and is hereby authorized to execute the application form and any other documents as required whether digitally or manually and to do all acts, deeds and things as may be necessary and/or incidental in this connection.

FURTHER RESOLVED THAT Mr./Ms. ........................., (Designation) be and is hereby authorized to sign certified true copy(ies) of the foregoing resolution to be submitted with appropriate authorities as and when necessary.”

For ......................... Limited

(signature)

(Name of the Director)

(Designation)

DIN: .....................

FORMAT #3

#. Authorisation for GST

“RESOLVED THAT (Name of the Officer), (Designation) be and is hereby authorised for obtaining Goods and Service Tax (GST) registration in the name of the company and to sign and submit applicable application form(s) and any other documents whether electronically on the official Goods and Service Tax (GST) portal and/or physically at concerned GST authority office(s).

RESOLVED FURTHER THAT (Name of the Officer), (Designation) be and is hereby authorised with the following powers on behalf of the company:

i) to sign and file the periodical returns, forms and any other documents as may be required to be filed by the company in compliance with the GST laws of the country;

ii) to make representations, correspondences and alterations on behalf of the company before State or Central GST authorities as and when situation arises;

iii) to appear in person before GST authorities and other statutory bodies in relation to any GST cases, assessments, appeals or otherwise as required;

iv) to make any additions, corrections or modifications to any documents, records, forms, papers, etc previously filed with the statutory authorities in connection with the compliance of GST laws; and

v) to take all necessary actions as and when required on all GST related issues of the company.”

Comments

Post a Comment

Leave Your Comments Here